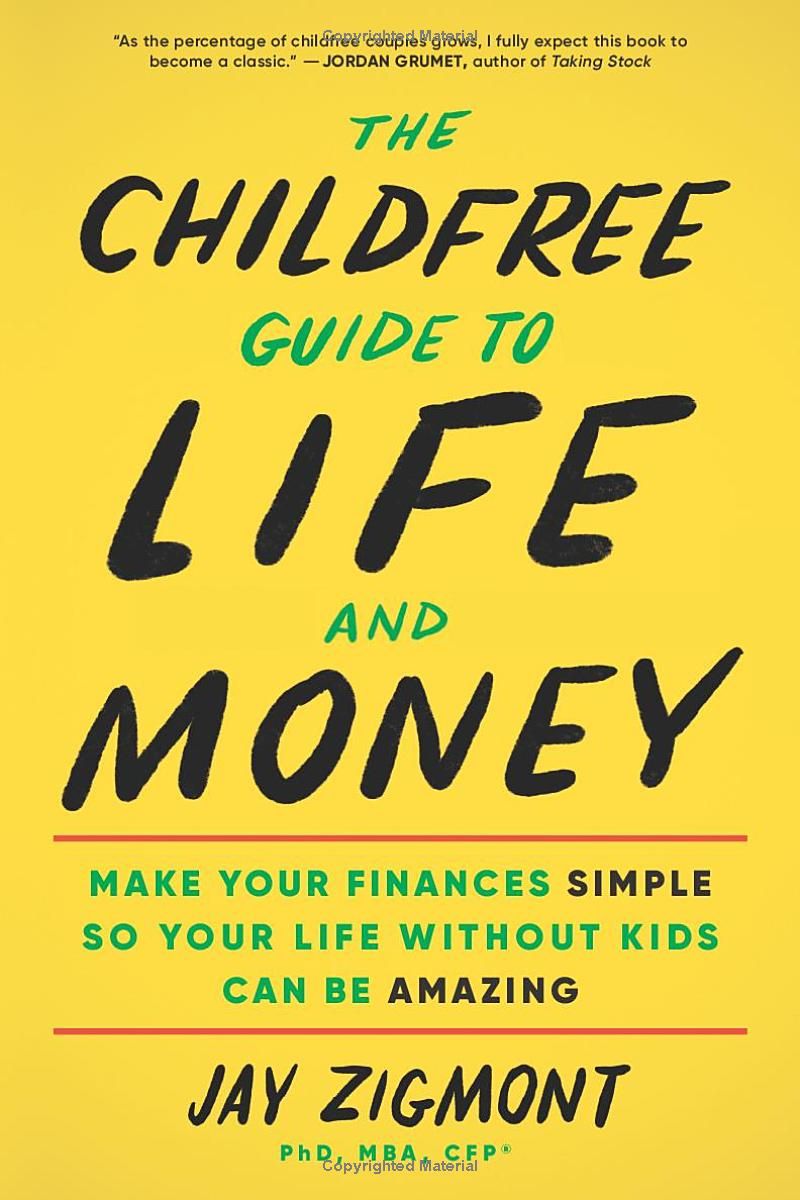

Are you childfree and ready to design a life and financial plan uniquely yours? Dr. Jay Zigmont's The Childfree Guide to Life and Money provides the essential framework. This comprehensive guide challenges traditional financial advice, recognizing the distinct financial realities of DINKs and SINKs. Forget the "Standard LifeScript"—this book empowers you to pursue your passions, whether it's buying a home, nomadic travel, or crafting the perfect retirement. Zigmont flips the FIRE (Financial Independence, Retire Early) model into FILE (Financial Independence, LIVE Early), offering eight No-Baby Steps to achieve your goals. Whether single, partnered, or planning a communal living arrangement, this book is your roadmap to financial freedom and a life lived on your terms.

Review The Childfree Guide to Life and Money

This book, "The Childfree Guide to Life and Money," completely exceeded my expectations. I went in with a mild curiosity, intrigued by the concept of a financial guide specifically tailored to childfree individuals, but I came out feeling genuinely empowered and optimistic about my future. What initially struck me was the author's remarkable inclusivity. Dr. Zigmont doesn't pry into why someone is childfree; he simply acknowledges that it's a valid life choice with unique financial implications, and that's a breath of fresh air. So many resources assume a traditional family structure, leaving those of us who have chosen a different path feeling lost and unsupported.

The book itself is brilliantly organized and incredibly accessible. While it delves into complex financial topics like budgeting, investing, and retirement planning, it does so in a way that’s easy to understand, even for someone like me who isn't a financial whiz. Dr. Zigmont uses clear, concise language, avoiding jargon and overwhelming technical terms. The eight "No-Baby Steps" he outlines provide a practical, step-by-step framework for building financial security, and I found myself constantly nodding along, thinking, "Yes! That makes perfect sense!" It’s not just about numbers and spreadsheets, though; the book cleverly weaves in discussions of lifestyle choices, career paths, and personal values, recognizing that financial planning is deeply intertwined with our overall sense of well-being.

I particularly appreciated the author’s emphasis on living a “FILE” life – Financial Independence, Live Early – rather than the more commonly touted FIRE (Financial Independence, Retire Early). This shift in perspective resonated profoundly with me. It’s not just about accumulating wealth and then retiring; it’s about strategically using your financial resources to live a fulfilling life now, while also planning for a comfortable future. This approach feels much less restrictive and more empowering, encouraging readers to prioritize their passions and desires throughout their lives, not just at the end.

Furthermore, the book offers a welcome dose of self-help and spiritual guidance. It recognizes the emotional and psychological aspects of financial planning, acknowledging that our beliefs and attitudes toward money significantly impact our ability to manage it effectively. This holistic approach sets it apart from purely transactional financial advice books. It’s about creating a life aligned with your values, and using finances as a tool to achieve that, regardless of societal expectations. In this regard, it’s a book that resonates not only with childfree individuals, but anyone seeking a more intentional and fulfilling path in life.

In conclusion, "The Childfree Guide to Life and Money" is a must-read for anyone who identifies as childfree, and I would strongly recommend it to anyone who’s questioning the traditional life script and seeking a more personalized approach to financial planning and life design. It’s informative, insightful, and incredibly supportive, offering a clear roadmap for building a financially secure and joyful future on your own terms. It’s a book I’ll be revisiting often, and a resource I’ll be recommending to everyone I know.

Information

- Dimensions: 5.5 x 0.76 x 8.25 inches

- Language: English

- Print length: 304

- Publication date: 2024

- Publisher: Sourcebooks

Book table of contents

- accountability partners

- activities of daily living (ADLs)

- Advice-Only Network

- aging care facilities

- aging care managers

- Allan, Robert

- Ally bank

- analysis paralysis

- antinatalism

- artificial intelligence (AI)

- assets

- assets under management (AUM)

- attorneys

- avalanche debt payment method

- bank accounts

Preview Book